How to register a company in Singapore from India? A Guide

How to register a company in Singapore from India?

A common question among Indian entrepreneurs is “How to register a company in Singapore from India? ”. Well, it is very easy for foreigners to open a company in Singapore. One has to just register with the Accounting and Corporate Regulatory Authority (ACRA) and ensure that the correct documents are provided. A key advantage of the Singapore company registration from India process is that a major chunk of work can be completed online. Therefore, it is very beneficial for Indian entrepreneurs and their businesses. Before moving forward, however, some things must be kept in mind- there are two ways to establish a company in Singapore:

- Registration of a foreign company: As an Indian citizen, you are a foreigner in Singapore. Therefore, you need to go through the Singapore company registration from India process. The registration fee can range somewhere around SGD 300 to SGD 1,000, depending on your situation. You will require certain relevant documents and a local representative who can vouch for you in Singapore.

- Being a local player: This is suitable for a Singaporean native. Therefore, this will apply to you if you are Singaporean-Indian. Here, you need to choose a suitable company structure, type, name, and other particulars. Having a registered address is also of equal significance. Once your company is open, you need to fill up the relevant paperwork.

Singapore offers foreigners the Entrepass. Possessing an Entrepass will assist you in keeping a track record of investments, which will benefit your business immensely.

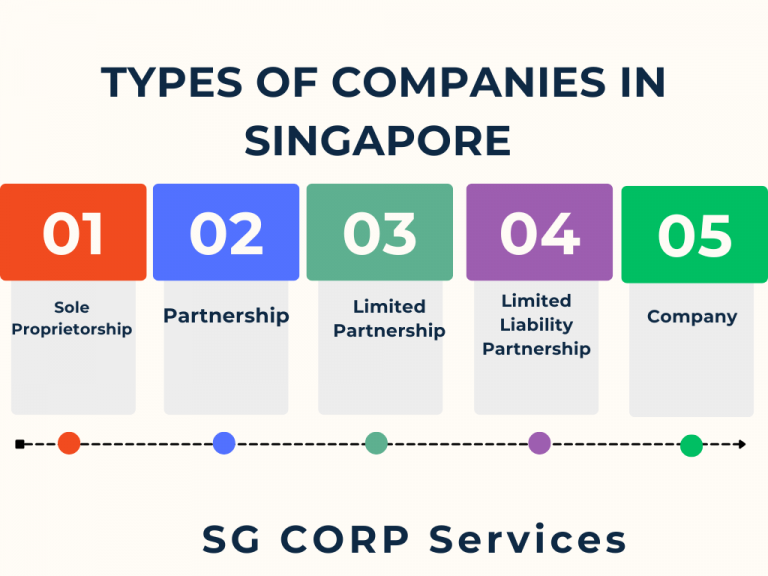

Types of Companies in Singapore

There are many types of companies that operate in Singapore. Some of them are:

- Sole Proprietorship: Refers to a small business that has one sole owner. This owner is responsible for everything- profits, losses, and debts. It is worth mentioning that this type is open to all, including natives, permanent citizens, and Entrepass holders.

- Partnership: This type of company is where ownership is shared between a minimum of two to a maximum of twenty people. The profits are taxed as part of the owner’s income tax. The Singapore company registration from India is open for this type. However, it is important to remember that having one local representative is mandatory.

- Limited Partnership: This is a business consisting of two partners. One is a general partner, while the other is a limited partner. Liability is reliant on the status of the partner. Since you are an Indian citizen, you have to appoint a manager who is a Singapore native.

- Limited Liability Partnership: This is a type of business where there are at least two partners. There is no strict rule regarding the number of partners you can have. The company is separate from the partners. In case you are opting for this type, the Singapore company registration from India must be completed by the two partners, and appointing a local manager is mandatory.

- Company: A company can be public or private. That determines the nature of its owner. It exists as a separate legal element from the personal assets of the partners or owners. Companies must have directors. Out of those directors, at least one of them must be a Singaporean native. The company is a separate legal entity and must not be categorised along with the personal assets of the owners. In case if you, as an Indian, want to be a local director of the company, you have to apply for the Entrepass. This can be obtained through the Ministry of Manpower.

Whatever the type of your company, SG Corp Services is always here to help. Therefore, you can hope to perform Singapore company registration from India smoothly with us.

Requirements to register a company in Singapore

There are some basic steps for Singapore company registration from India. These steps are listed below:

- At least one shareholder must be there

- One Resident Director who must have the Entrepreneur Pass or Employment Pass

- One company secretary (to be appointed within the first six months of the company’s incorporation)

- A shareholder or director (Can be the same or different people)

- A maximum of 50 shares for a private company

- Full local or foreign shares allowed

- A director or representative must be present for the bank opening process in Singapore

If you keep a note of these requirements, Singapore company registration from India will be smooth sailing.

Important Documents

There are some important documents that you will need during the Singapore company registration from India process. There are different needs for Individual and Corporate Shareholders.

Individual Shareholders

- Application forms signed by the authority

- A copy of the Aadhar Card

- Recent utility bill or bank statement

- Resume

Corporate Shareholder

- Updated Resume

- Incorporation Certificate

- Articles of Association of the mother company and memorandum

- Passport copies of UBOs/ Directors/ Shareholders

- Aadhar card copy

- Most recent utility bill/ bank statement

Duration of the Singapore company registration from India

As a foreigner from India, it is natural for you to be stressed about the Singapore company registration from India. Therefore, please note that generally, the entire registration process usually takes 1 to 3 days. For smooth execution, you must provide accurate documents. In case of any complexity, the process might be extended only up to a few weeks. Only if it requires intervention from higher authorities will this period last two months. If you choose SG Corp Services, we will guarantee that the registration process will go very smoothly.

Company Registration Cost

It is important to note that the Singapore company registration from India process requires several key costs. These costs are:

- Name Reservation Fee: SGD 15 (approx.)

- Company Registration Fee: SGD 300 (approx.)

These are mandatory fees. In total, an approximate of SGD 315 goes to the Accounting and Corporate Regulatory Authority (ACRA) during the registration process.

Other than this, additional costs include:

- Corporate Secretarial Service Provider Fees: This depends on the service provider of your choice.

- Registered Office Address: Again, this depends on the choice of your service provider.

All in all, the total company registration cost in Singapore will amount to somewhere between SGD 3,000 and SGD 4,000, approximately.

Other costs

Going through the Singapore company registration from India is not the end. Once you establish your company on Singaporean soil, you have to sustain it. Considering this, it is worth mentioning that operating a company in Singapore is reliant on several factors. The most notable among these factors are the type of business, company structure, operating expenses, attitude of the customers, state of the industry, and economy. As an Indian entrepreneur, you should be particularly aware of these costs:

- Employee salaries, benefits and others

- Equipment costs

- Office rent and other utilities

- Marketing and adjacent costs

- Legal fees and taxes

According to recent estimates, the total company sustenance cost for a medium-sized and small company in Singapore is approximately within the range of SGD 6,000 to SGD 55,000. Hope this answers all your doubts regarding how to register a company in Singapore from India.

All material on this website is provided for information only, and is not intended to form part of any offer or contract.

Our policies and practices may change at any time without notice. Details of properties are provided from information received, and their accuracy cannot be guaranteed.

Copyright © reserved by SG CORP Services. Website Design – by ESPPL