It is easy to do business in a country like Singapore. This is because we offer easy accounting and tax services in Singapore. Here we offer a comprehensive tax system and friendly regulatory framework. Companies operating in Singapore must obey the tax regulations and accounting system of that particular geographical location.

Most of our tax experts and accountants are well-versed and accustomed to the financial rules of Singapore and its tax laws. We do ensure that your business stays compliant and operates with absolute efficiency.

We offer numerous accounting services like GST compliance, payroll management, bookkeeping, and corporate secretarial services.

In a country like Singapore, every corporate business is unique. Our solutions are designed in such a way that they meet your demands. In turn, you get maximum results for your organization.

When you use our advanced accounting software and tools you receive accurate results, while your financial data remains secured.

Our team of expert accountant provide you quick answer to all your queries and concerns and resolve your doubts.

In a country like Singapore, ACRA, and IRAS have strict guidelines regarding tax filing and financial reporting. If you don’t comply with it can lead to reputational damage, legal issues, and penalties.

If you have a well-maintained account then you get a clear-cut picture regarding the company’s financial health and make correct business decisions.

When you properly plan your taxes it reduces your liability at once but your company remains compliant with the country’s tax rules and regulations.

If correct financial data is present with you, then you can think of expanding your business, efficient allocation of resources, and supporting long-term goals

When our experts perform proper accounting and taxation services they ensure smooth operation and peace of mind. This, in turn, reduces errors, audits, and penalties.

We offer unique types of accounting and tax services in Singapore. Our experts aid them to remain compliant with rules and regulations and manage their finances with full efficiency. Some of our key services are as follows.

Our expert accountant offer proper accounting services to ensure that your financial records remain updated and correct. The services offered by us include general ledger maintenance, financial statement preparation, and account reconciliation.

Without the guidance of an expert, it becomes utterly difficult to move through the tax structure and system of a country like Singapore. Some of our taxation services consist of income tax filing of an individual, tax filing of corporate structures, GST submission, and registration.

Somehow if your business annual income exceeds more than Singapore dollar 1 million. Then it is mandatory to opt for GST registration. Some of the services that our experts provide you include submission and preparation of quarterly GST returns, registration process of GST, and ensuring compliance with GST regulations.

Our expert accountants perform accurate payroll processing for regulatory compliance and employee satisfaction. The payroll management services offered by us consist of filing of annual forms, calculating central provident fund contributions, payslip generation, and monthly salary calculation.

Our expert chartered accountants can easily prepare all kinds of financial reports for you and assess the performance of the business. Some of the services that we provide to our clients include forecasting and budgeting, quick analysis of your financial trends and performance metrics, and preparation of management accounts.

Our expert accountants ensure that your business meets with required statutory requirements. Some of our key offerings include the maintenance of statutory registers, filing and preparation of annual returns, strict compliance with corporate governance standards, and company incorporations.

Whichever clients require auditing support we provide that with the aid of our experienced chartered accountant. Some of our services include Liaising with auditors, audit preparation and documentation, and ensuring compliance with audit standards.

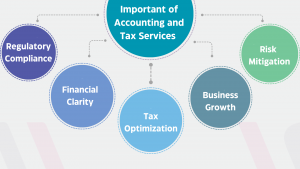

Our experts offer a wide range of professional accounting and tax services to our clients across Singapore. Some of the benefits that we offer are as follows.

Our professional accountants are trained to perform accurate tracking of expenses, assets, liabilities, and income. It is absolutely important for decision-making and financial planning. Our experts perform the work of accounting with absolute perfection as a result it reduces the likelihood of misreporting, miscalculations, and accounting errors.

In a country like Singapore, regulations and tax laws are continuously changing. Therefore, our professional accountants always stay up to date so that they can easily comply with the upcoming rules and regulations and avoid penalties. As they stay updated regarding the latest rules and regulations, they ensure all forms are submitted on time and that all documents and forms are appropriately prepared.

As our accountants have the experience they can quickly identify all sorts of tax-saving opportunities like deductions and credits to minimize tax liabilities. Our accountants provide long-term strategies to optimize your tax benefits.

Our accountants are trained to offer numerous tailored advice on investing, managing debt, and budgeting based on an individual’s business-specific needs. Even they provide detailed insights on how to manage cash flow, plan for future growth, and improve profitability.

We provide you Accounting and Taxation Services. Our services include financial services, preparation of tax returns, tracking expenses and revenues, producing financial records, CPF/GST registration. At the end of every month, you clients can view your statements online and manage your business operations more efficiently.

More about our Accounting services:

Taxation Services:

In tune with the business cycle fluctuations, the Government is announcing various tax sops,incentives, deductions and allowances and these changes will have a huge impact on the tax bill of the companies, if these exemptions are not taken into account properly. Our taxation experts keep track of these tax implications and offer suitable tax solutions which touch upon every segment of tax framework of your organisation.

Our services include: